Why Serve

mAKE A DIFFERENCE IN YOUR COMMUNITY

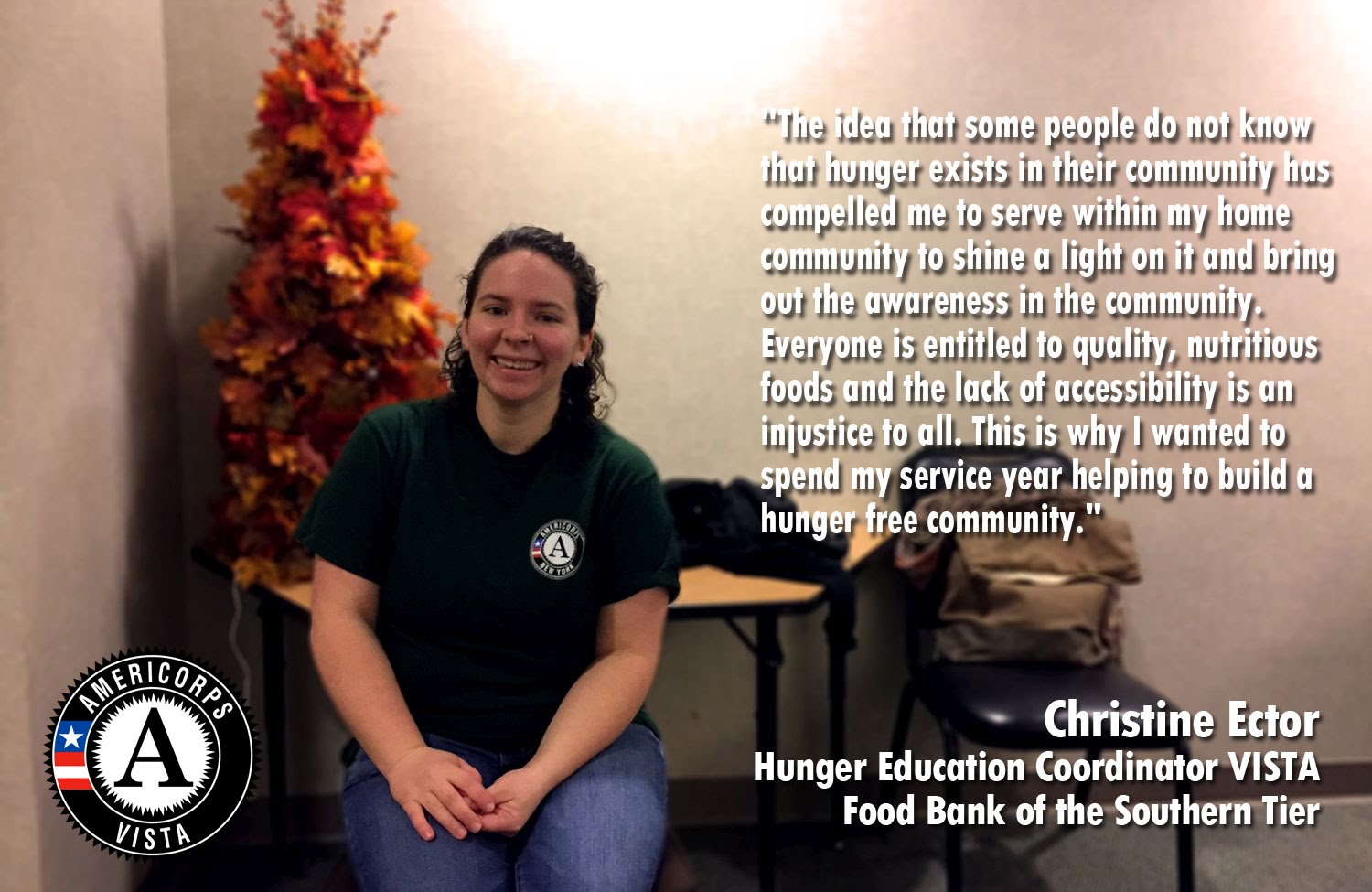

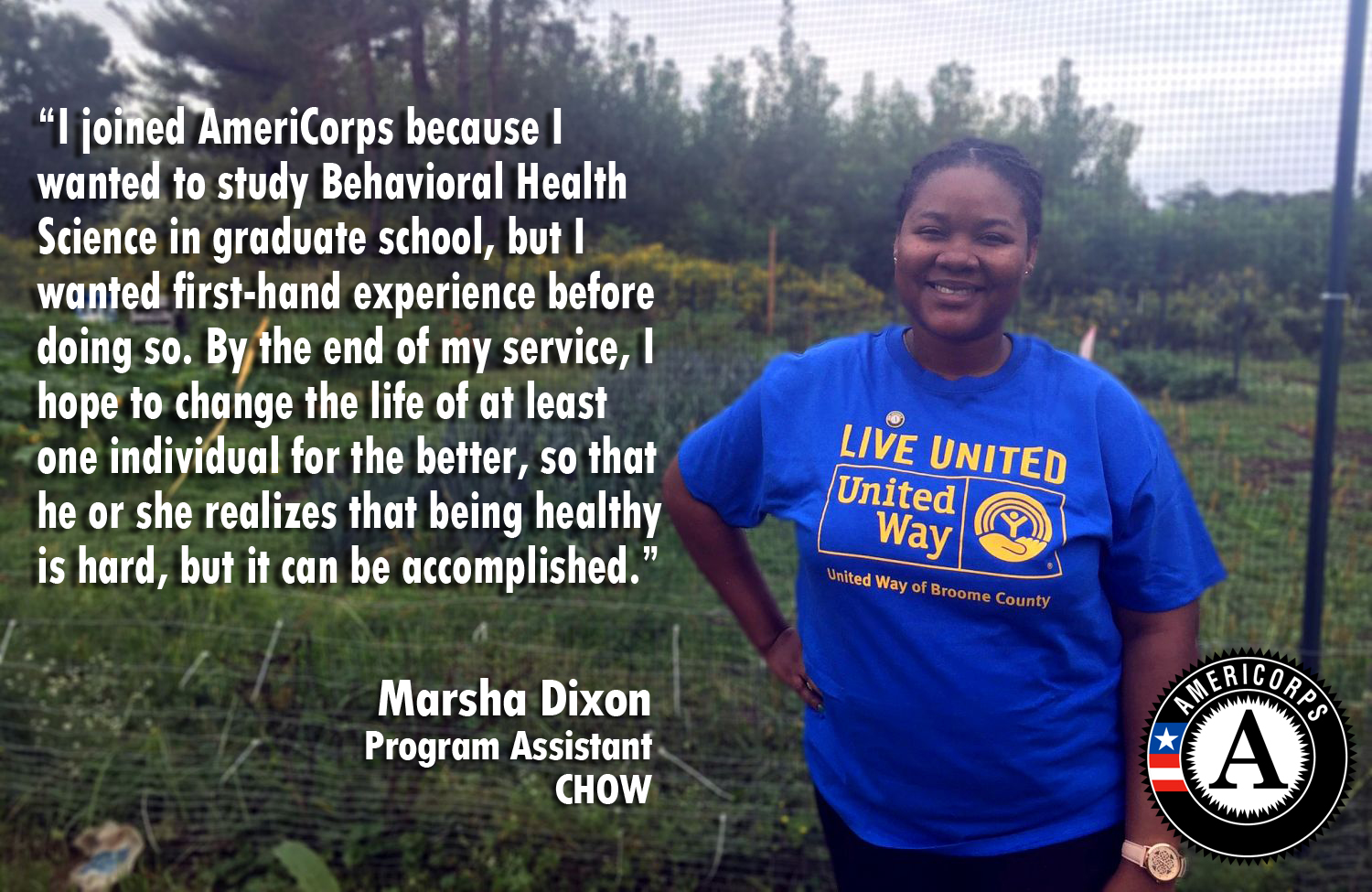

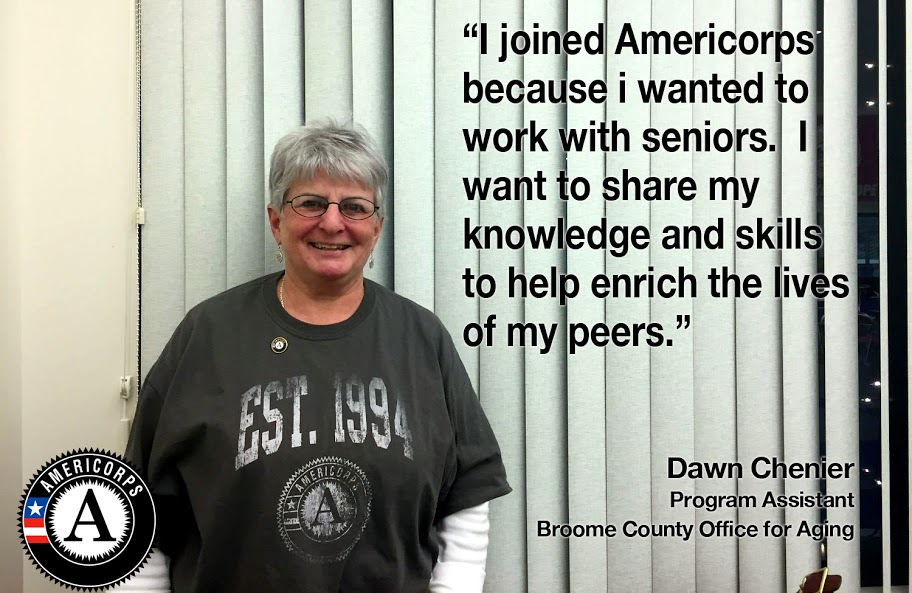

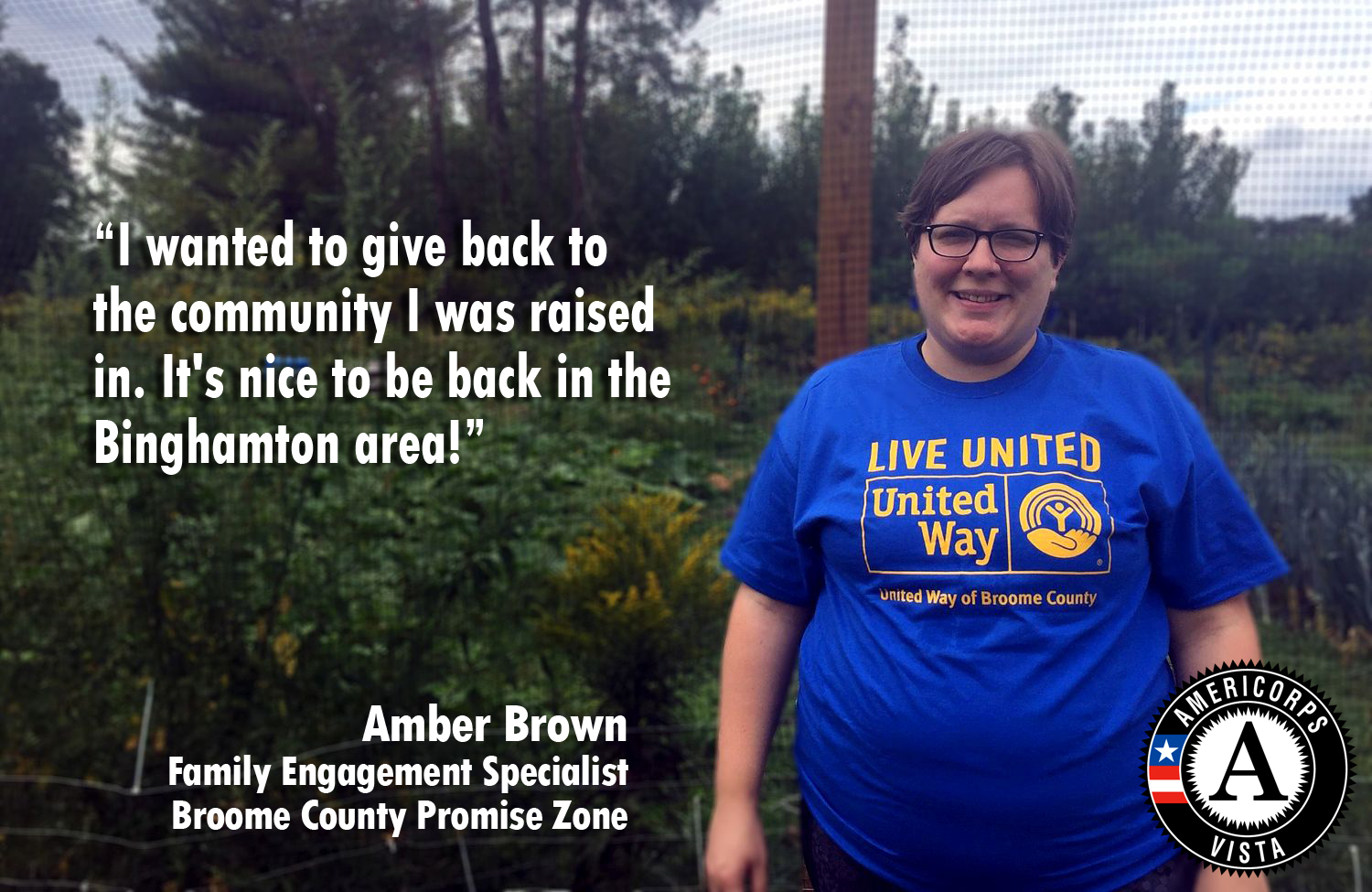

AmeriCorps provides the opportunity for individuals to engage in meaningful service that will leave a deep, lasting impact on the organizations and communities served, as well as on the member. Joining AmeriCorps allows people committed to service put their passion and skills to work helping others, while they develop professional skills, build teamwork and leadership abilities, learn more about the areas of nonprofit management and community health, and connect with a broad network of AmeriCorps members, alumni and supporters.

RHSC members gain a deeper understanding of the unique needs, challenges and assets of rural communities, lending a fuller view of the diversity of American communities. Members play a critical role in the organizations and communities they serve, and can truly see the impact their service is having in people’s lives, organizations and communities.

AmeriCorps engages more than 75,000 Americans in intensive service each year at nonprofits, schools, public agencies, and community and faith-based groups across the country. Since the program’s founding in 1994, more than 900,000 AmeriCorps members have contributed more than 1.2 billion hours in service across America while tackling pressing problems and mobilizing millions of volunteers for the organizations they serve.

Benefits

Living Allowance

Members receive a modest living allowance during their term of service. The living allowance is paid bi-weekly in equal increments while serving. The living allowance is not a wage, as an AmeriCorps position is not a job. The Living Allowance is taxable, and the biweekly amount for each member will vary based on tax withholdings.

Segal Education Award

After successfully completing a term of service, members receive the Segal Education Award. This award can be used to pay off existing qualifying student loans or to pay educational costs at eligible post-secondary educational institutions. The dollar amount of a full-time award is tied to the maximum amount of the U.S. Department of Education’s Pell Grant and can vary from year to year. AmeriCorps members may earn up to the value of two full-time education awards and have seven years from the date they earned each award to use it. The Education Award can be divided up and used at different times and for different authorized expenditures. The Education Award is considered taxable income by the IRS, and therefore must be claimed on your taxes in the year(s) that the award is used.

Student Loan Forbearance

Members may put qualifying federal student loans into forbearance during their term of service. This means you will not need to make payments while serving. Please note that while loans are in forbearance, they continue to accrue interest, and the National Trust will pay all or a portion of the accrued interest. These interest payments are considered taxable income and must be claimed when filing your taxes.

Child Care

Assistance

Qualifying full-time service members are able to receive a child care subsidy, paid directly to the child care provider, during their term of service.

Health

Insurance

Individual health care insurance is available at no cost for full-time members who do not have health insurance at the time of enrollment, or who lose their previous coverage as a result of AmeriCorps service. AmeriCorps Health Insurance meets the standards of the Affordable Care Act.

Application

Successful applicants (minimum age 18) will demonstrate the following proficiencies and values:

- An interest in, and commitment to, health and/or rural communities and people

- Evidence of current and/or past volunteer service activities

- Communication skills, including writing and verbal communication with clarity and accuracy

Self direction : Members must be self-directed and show evidence of their ability to work independently and efficiently- Applicants must be US citizens or permanent residents, clear a National Service Criminal History Check, and have their high school diploma or GED